Tucson’s Bourn Companies Plan Second Renaissance for Foothills Mall

TUCSON, Arizona – Tucson-based, Bourn Companies (Don Bourn, manager) and its affiliate, FHM Partners, LLC have announced the acquisition of Foothills Mall from Columbus-based Schottenstein Property Group, Inc. (SPG).

Bourn has had past experience with the 514,379-square-foot mall, owning it back in 1994 when it was at 12% occupancy and then selling it in 1999 at 95% occupancy, after repositioning it into its current format of outlet and promotional retailers, restaurants and a theatre – the first Renaissance.

Since then, the mall has gone through several owners, the latest being SPG, a vertically-integrated owner, operator, and redeveloper of neighborhood shopping centers throughout the United States

Foothills Mall faced difficulty in 2016 after nearly two decades of success with the outlet mall concept, after the opening of the Tucson Premium Outlets in nearby Marana. Within six months of the outdoor mall opening, major tenants such as Saks Fifth Avenue’s Off Fifth outlet, Old Navy’s Outlet, Hanes and Nike Factory Store closed or announced plans to close their existing Foothills Mall locations in favor of a store at Tucson Premium Outlets.

Despite these departures, the Foothills Mall’s occupancy rate is approximately 73%, according to a prepared statement from Bourn, with many tenants performing well. These tenants will provide a solid foundation for redevelopment….again, a second Renaissance.

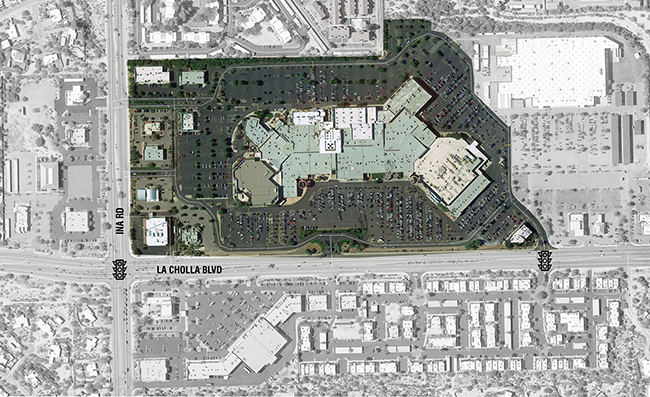

The full 750,000-square-foot center sits at the northwest corner of La Cholla Blvd and Ina Road in upscale northwest Tucson. Mall tenants include Barnes & Noble, Ross Dress for Less, buybuyBaby and a 15-screen Lowes Cinema, alongside a 209,000-square-foot Super Walmart, Applebee’s and Outback Steakhouse on the perimeter of the mall.

“This property is a terrific large-scale in-fill location, strategically located to serve northwest Tucson, including Marana and Oro Valley. This is A+ real estate,” Don Bourn, President of Bourn Companies said in the statement.

George Larsen, CCIM, of Larsen Baker, also a Tucson retail developer says, “Bourn is the perfect owner for this property, if anyone can turn it around, it’s Bourn! Being local is important to understanding the property and Bourn has contact all the necessary national retailers. The mall will probably be demalled into more open-air shopping. It could also be redeveloped into a mixed-use, similar to the metamorphosis that took place at the El Con Mall – a more lifestyle center.”

Bourn said in a statement, “It won’t be overnight, the change may take two to four years.”

Terms of sale were undisclosed. However, public records indicate the property was refinanced in 2006 with an $81 million, 10-year fixed rate first mortgage bearing 6.08% interest, and the property was marketed per appraisal and note value.

For more information or leasing, Alan Tanner with Bourn Companies should be reached at 520.323.1005.

Login in for additional information.

[mepr-show rules=”58038″]Buyer assumed the note as a deed in lieu for $17.5 million ($34 PSF) due Dec. 16, 2017 with optional extensions for two additional 6 month periods.[/mepr-show]