Labor growth returns, but momentum remains uneven.

Labor growth returns, but momentum remains uneven.

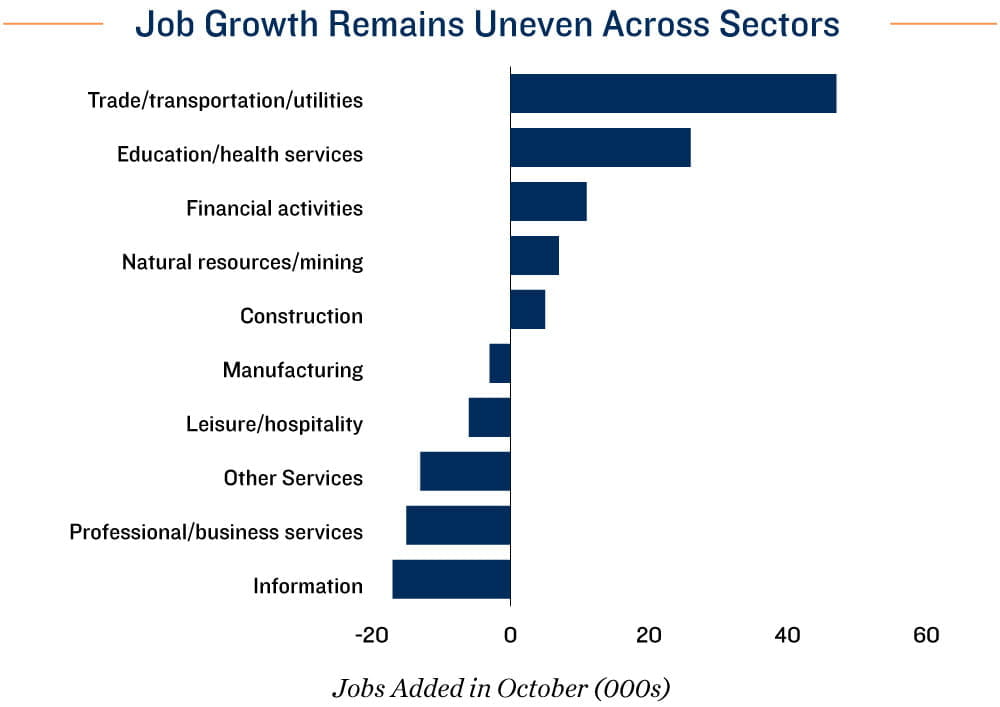

(November 13, 2025) -- Despite the government shutdown, private-sector employment remains an essential barometer for investors and policymakers. The latest ADP National Employment Report showed a modest rebound in October, with private employers adding 42,000 positions after two months of contraction. Gains were concentrated in the trade, transportation, and utilities sectors—reflecting improved supply chain fluidity and renewed business confidence.

However, most other industries either shed jobs or posted negligible growth. ADP data also indicated that wage gains have flattened mainly in 2025, suggesting a cooling labor market. While the recent uptick offers a brief reprieve from recession concerns, underlying employment conditions remain fragile—likely reinforcing the Federal Reserve’s ongoing rate-cut trajectory unless job creation becomes more broadly based.

Seasonal Hiring Reflects Mounting Worker Pressure

Interest in temporary and part-time roles has risen sharply. Indeed reported a 27 percent year-over-year increase in job seeker interest for seasonal positions at the end of September—up 50 percent from 2023 levels. Yet postings for these jobs grew just 2.7 percent over the same period, signaling an imbalance between worker demand and employer hiring.

The San Francisco Federal Reserve noted that the share of involuntary part-time workers rose from 30 percent in 2023 to 38 percent by August 2025, underscoring labor market slack and increasing worker vulnerability. Many households that rely on holiday-season employment may find fewer opportunities, limiting disposable income growth among lower-income consumers. Retailers such as Target have already announced plans to rely more on existing staff to meet holiday demand.

Layoffs Concentrated Among Large Firms, But Still Below Crisis Levels

Corporate downsizing accelerated in October. Challenger, Gray & Christmas reported that announced layoffs reached their highest monthly total since 2003, with major employers such as Amazon, General Motors, and Paramount initiating reductions. Even so, total job cuts remain below recessionary thresholds.

Through the first 10 months of 2025, announced layoffs exceeded 1 million—the largest year-to-date tally since 2020, but still roughly half the rate recorded during the 2009 downturn. Larger employers remain comparatively resilient; ADP data showed these firms added more than 70,000 jobs in October, while smaller businesses continued to post net losses.

White-Collar Job Losses Pose a Risk to Consumer Spending

Labor market weakness is beginning to reach higher-income segments. The information and professional services sectors have both registered job declines for three consecutive months. Because upper-income households have sustained much of the nation’s discretionary spending, this softening could temper consumption trends in the months ahead.

Luxury retailers may face reduced sales momentum, while high-end multifamily properties could experience slower lease-up velocity as employment uncertainty impacts higher-earning renters.

Trade Easing Supports Industrial Activity on the West Coast

Recent progress in U.S.–China trade negotiations has added a modest tailwind for logistics and industrial markets. China has agreed to lower its tariff on U.S. goods from 24 percent to 10 percent, while the United States has paused additional hikes, maintaining its current 25 percent rate.

This detente has bolstered West Coast port volumes, which have rebounded following a mid-year slowdown, and likely contributed to hiring strength within the trade, transportation, and utilities sectors. Improved trade clarity could further support warehouse leasing demand, which reached its highest level in more than a year during the third quarter.

Labor Highlights (Through October 2025):

- 597,000 jobs added year-to-date*

- 20,000 average monthly job gains over the past six months

*ADP private-sector employment only; excludes government jobs

Sources: Marcus & Millichap Research Services; ADP National Employment Report; Bureau of Labor Statistics; Challenger, Gray & Christmas, Inc.; CME Group; CoStar Group, Inc.; Federal Reserve; Indeed Hiring Lab; Moody’s Analytics; Real Capital Analytics; RealPage, Inc.

Read the full research brief here: Employment